A who’s who of Vanuatu’s financial industry and its regulators converged at Port Vila’s Warwick Le Lagon resort on June 27 to discuss the new licence for virtual asset service providers (VASP) and to review the jurisdiction’s best strategies to avoid global regulatory watch lists. This was the second Symposium organized by the Vanuatu Financial...

Watch the full symposium in three parts:

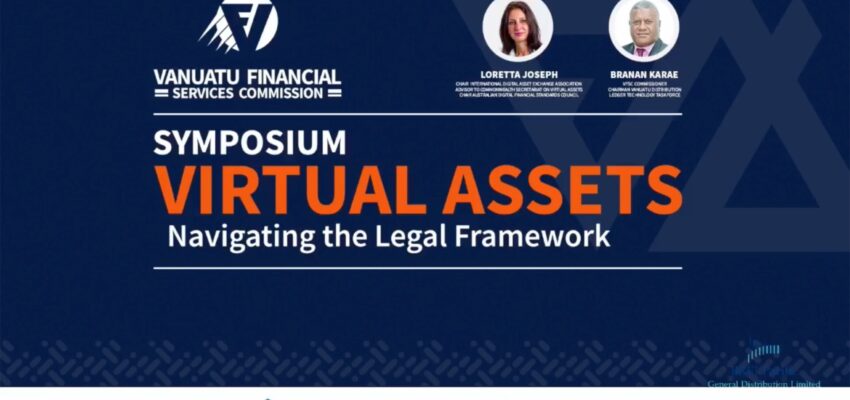

At a recent symposium, Vanuatu’s budding fintech industry was widely hailed as a strategic sector for the economy. While there are still a few challenges, all participants agreed that the opportunities promise a bright future for the country’s youth. The Symposium “Virtual assets: Navigating the legal framework,” hosted by the Vanuatu Financial Services Commission (VFSC)...

A core group of 60 brokers remain after licensing rules were strengthened. Industry insiders cite Cyprus as an inspiration for Vanuatu’s future. This article first ran on June 22, 2023 on FinanceMagnates.com. Just five years ago, Vanuatu had 600 active Financial Dealer Licenses (FDL). Today, there are only 60, but the jurisdiction has traded quantity...

Dear Licensees, If you receive this letter, you are among 60 firms (as per VFSC count on June 13) that currently hold an active Vanuatu Financial Dealer License (FDL). Congratulations! This means you have successfully completed your application by meeting all the requirements introduced in 2021 when the Financial Dealers Licensing Act was last updated....

Following last year’s amendment to the Financial Dealer Licensing Act of 2018, our regulator, the Vanuatu Financial Services Commission (VFSC), is now requiring all applicants for a Financial Dealer License (FDL) to establish a physical presence as well as economic substance in Vanuatu. In practical terms, this means that, from October 2022 onward, every FDL...

Founded in 2020, TradeNext brings a fresh vision to FX and CFD brokerage with a specific focus on the mobile experience – bringing Wall Street to the palm of traders’ hands. While TradeNext works both on desktop and mobile, traders can jump seamlessly from one device to another, and start trading anytime, anywhere. Behind TradeNext’s...

FMA Vanuatu is pleased to announce that a new member organization has joined its ranks: Exness.com. Exness is a global multi-asset broker with their very own trader app and terminal, in addition to MetaTrader 4, 5, and Mobile. They offer brokerage services for forex, metals, cryptocurrencies, energies, stocks and indices. Their platform also includes high-end...

When compared with leading jurisdictions around the world, Vanuatu’s regulatory regime more than holds its own; only a few moderate improvements would bring the industry to the next level, according to a comparative report sponsored by FMA Vanuatu. Our trade group worked with a Singapore legal firm to gather insight from nine benchmark jurisdictions, both onshore...

In a public notice posted on May 26, 2022, the Vanuatu Financial Services Commission announced that the following licensees have not engaged in Financial Dealers business, and do not have investor funds in their custody, therefore no investors will be affected by the withdrawal of their license and the payment of their bond deposit; consequently,...